Curious About Our Numbers?

72

Total Territories Awarded

$1,052,668*

Top 10% Avg Year Revenue

*As published in item 19 of our FDD dated 5/25/25

As a Franchisee

Your Mobility Consultants will offer a wide range of products and services tailored to fit the needs of your customers. Your store will become a community resource, assisting your customers in finding what will have the biggest impact on their daily lives. You are not only showcasing curated high-quality products, such as scooters, ramps, and lifts, but you're also educating your customers on the possibilities ahead of them. We have a saying: "go where you want to go", and it's our mission to help you get there.

Scooters & Power Chairs

Portable & Modular Ramps

Lift Chairs & Stair Lifts

Fall Prevention & More

Opening Support For A Quick And Simple Start Up

Comprehensive Training

Site Selection Support

Pre-set Opening Inventory

Grand Opening Marketing

Investments Costs

Mobility Plus*

Home Access

Mobility Plus*

Stores

Mobility Plus*

Systems

Franchise Fee

$30,000

$30,000

$60,000

1st Year Investment Range

(Includes Franchise Fee)

$105,245 - $152,920

$291,175 - $464,175

$330,595 - $522,595

Funding Options

Self-Funded, SBA Loan, 401K Rollover(ROBS), Home Equity Line of Credit(HELOC),

Apply NowMobility Plus*

Home Access

Mobility Plus*

Stores

Mobility Plus*

Systems

Franchise Fee

$30,000

$30,000

$60,000

1st Year Investment Range

(Includes Franchise Fee)

$105,245 - $152,920

$291,175 - $464,175

$330,595 - $522,595

Funding Options

Self-Funded, SBA Loan, 401K Rollover(ROBS), Home Equity Line of Credit(HELOC),

Apply Now* Not available in all 50 states.

Franchise Funding OptionsThe Mobility Plus Advantage

Sales – Service – Rentals – In-Home Services – Government Contracts

Offer a "Complete Solution" to support your customers through every step of their mobility journey.

Expert training from day one, with ongoing support from our corporate team to keep you growing strong.

Directly impact veterans, seniors, caregivers, and those affected by injury or disability.

The largest generation in the US is now aging into seniors. By 2035, there will be a projected 78 million seniors nationwide.

Your Mobility Plus Store

Product Options

Scooters

Power Chairs

Lift Chairs

Stair Lifts

Ramps

Vertical Lifts

Vehicle Lifts

Hospital Beds

Grab Bars

Wheelchairs

Manual Devices

+ More!

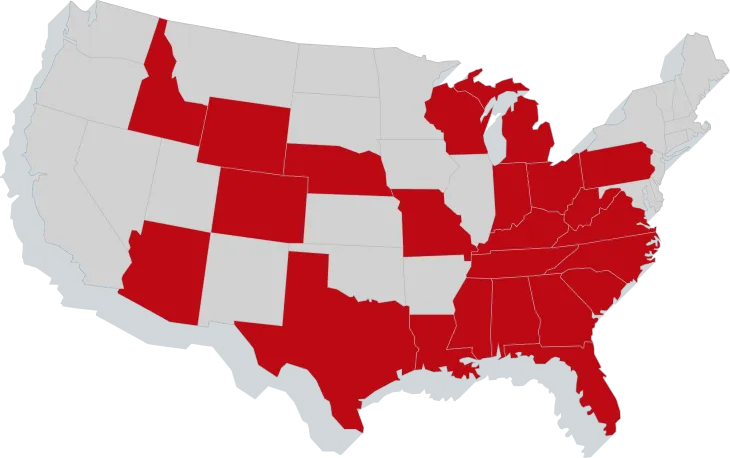

Available Territories

Existing Franchise Locations

Unavailable Territories

Funding Sources

If you're looking for franchise funding options, there are several sources to consider. The right choice depends on your financial goals, timeline, and comfort level with borrowing. To help you understand what's available and determine which option best supports your path forward, here are a few funding sources to explore:

ROBS (Rollover as Business Startups)

Alternative Lenders

Crowdfunding

HELOC (Home Equity Line of Credit)

SBA Loan (Small Business Administration)

Bank Loan

At Mobility Plus, we understand that securing funding is an important step in your journey. That's why we work with you to find financing options that fit your unique needs and goals. Our team of experts is here to guide you through the process and help you choose the path that supports your long-term success. Let us help you take the first step towards achieving your dreams of owning a franchise business!

TAKE THE NEXT STEP

Due to the High Demand for a Mobility Plus franchise we have implemented a process beneficial to both parties. We have a limited amount of territories available and an overwhelming interest

1

Complete our form below so we can learn about you.

2

Upon review we will reach out to schedule a call.

3

If the fit is right for both parties, we will send you information on becoming a franchisee.

4

Sign a franchise agreement, get trained and make money.

Call us today!

(877) 271-4080